Bitcoin

Part of a series on Cryptocurrency. [View Related Entries]

[View Related Sub-entries]

About

Bitcoin[1] is a virtual cryptocurrency regulated by a peer-to-peer network that creates a time-stamped register yielding chains of valid transactions. Unlike other digital currency systems or credit payments, Bitcoins are treated like cash and transactions cannot be reversed.

History

The need for a digital currency based in cryptography[2] was discussed in two separate academic papers published in 1993 by researchers at Carnegie Mellon University[6] and the University of Southern California.[7] Five years later, the idea was introduced to the the Cypherpunks[3] mailing list[4] by cryptography advocate Wei Dai, who suggested a system in which the currency would be both regulated and created through crowdsourced cryptography, thus eliminating the risk of double-spending altogether.

Proposition

On November 1st, 2008, a Japanese American physicist named Satoshi Nakamoto[8] distributed a paper[9] solidifying this idea into a nine-page proposal for something called "Bitcoin" via the Cryptography Mailing List.[10] The first blockchain was generated on or before January 3rd, 2009, as its Genesis Block[11], or first block, references the title of an article[12] published that day in the UK newspaper The Times about a physical bank bailout.

Early Development

According to Newsweek's investigative report[95], Satoshi Nakamoto began working on the Bitcoin code in early 2009 with a group of other programmers, including Finnish programmer Martti Malmi and Australian developer Gavin Andresen, which culminated in the public announcement of the system and release of the first open-source wallet software via Cryptography Mailing List[13] on January 9th, 2009. The announcement envisioned that the total circulation would consist of 21 million coins, made available in increments with the full amount made available by 2140. The article also described Nakamoto as a genius physicist and mathematician who took cautious measures to protect his identity.

A photograph of Satoshi Nakamoto as printed in the Newsweek article

"He was the kind of person who, if you made an honest mistake, he might call you an idiot and never speak to you again," Andresen says. "Back then, it was not clear that creating Bitcoin might be a legal thing to do. He went to great lengths to protect his anonymity."

Exchange Market

On July 18th, 2010, the exchange market Mt. Gox[19] launched, allowing people to buy and sell Bitcoins as well as providing software for merchants to accept Bitcoins as payment on their online storefronts. The site also offers a live ticker of Bitcoin exchange rates (shown below). They claim to facilitate more than 80% of all Bitcoin trading as of March 2013.[20]

Mining

Bitcoins are generated through a process known as “mining,”[22][26] which adds transaction records to Bitcoin’s public register known as a block chain.[23] The chain exists as a record of Bitcoins spent in actual monetary value and to bar attempts from double-spending, or spending previously used coins. The process is meant be challenging, requiring a piece of data known as a proof of work[24] that has an ever-changing very low probability[25] for getting the hash for each transaction correct on the first try. The actual act of mining can be completed by dozens of different programs[27] for multiple operating systems, including Android. A ledger of the most recent blocks is provided by BlockExplorer.[25] A handful of miners have shared their mining hardware setups made from both desktops (shown below, left) and mobile phones (shown below, right) on YouTube.

Regulation

On March 18th, 2013, the United States Financial Crimes Enforcement Network issued a clarification[28] to the regulation regarding virtual currencies. Though the statement does not explicitly address Bitcoin, it stipulates that businesses that exchange American dollars for digital currencies qualify as Money Services Businesses (MSBs) and should thus be subject to federal regulations and must comply with money laundering laws.[29] However, users of the currency, or people who mine the currency for themselves, do not qualify as an MSB.

Inflation

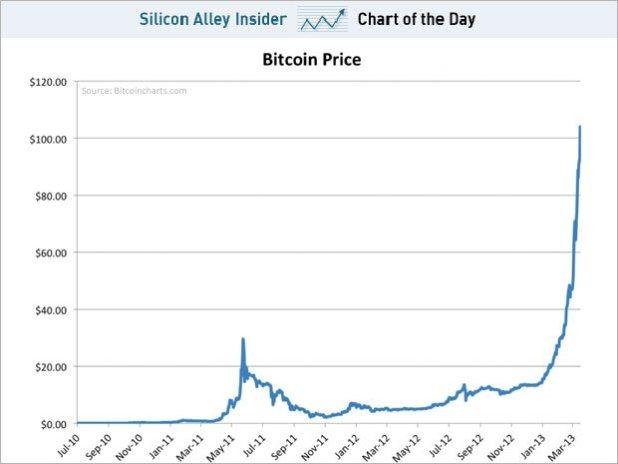

In February 2013, Bitcoin’s value began increasing drastically and by mid-February, the price of Bitcoins had doubled from $13.50 per coin at the beginning of the year and risen above $27 per coin for the first time since 2011.[50] Despite a glitch that caused the price to drop 23% in mid-March[51], the Bitcoin value continued to rise throughout the month and reached $100 for the first time on April 1st.[52] Many analysts cautiously declared the trend a bubble, including Wall Street analyst Nick Colas who noted that the inflating value of Bitcoin was a “perfect storm”[53] attributed to a combination of a tech-savvy userbase, a large group of people unhappy with traditional banks and their policies, deposit taxes in European countries, constrained and predictable supply, and a clarification of U.S. regulations on its trade.

On April 3rd, Bitcoin’s trading value hit an all-time high of $147[54], leading to more concerns about the currency’s possible hyperdeflation[55], or a sudden, drastic collapse of its value. The same day, Bitcoin service Instawallet shut down indefinitely following a hack that revealed the vulnerabilities in their system’s architecture.[56] Despite this, the value continued to rise through the first week of April, reaching an all-time high of $194.90 on April 8th, 2013. The same week, a handful of other Bitcoin sites including Mt. Gox and Bitcoin-Central reported[57] security breaches and DDoS attacks.

In late 2017, the price of a bitcoin soared astronomically, reaching over $17,000 per bitcoin.[103] This is because financial companies Cboe Global Markets and CME Group, will start offering bitcoin futures in December of 2017.

Bitcoin Futures

On November 28th, 2017, Bitcoin reached the trading-value high of $10,000 and surpassed that the following day, reaching $11,000.[98][99] The gains were more than 1,000% since January 2017. This means that one bitcoin is worth $11,000. The BBC[100] claims that most of the increased value is due to speculation. They write, "Some say it's a classic economic bubble: frenzied investors paying far more for an asset than it's worth for fear of missing out. They put it in the same bracket as the mania for Dutch tulip bulbs in the 1630s or internet companies in the dot.com boom."

Following the increase, the increase in value, the NASDAQ stock https://knowyourmeme.com/memes/sites/redditexchange announced that they would begin trading on Bitcoin futures in 2018. Quatz write, "Bitcoin futures give sophisticated investors an instrument to hedge their bets in the cryptocurrency and could help professional traders overcome their hesitation to get involved in the bitcoin markets. As bitcoin futures markets are being developed, other tools that traditional investors are used to are also being built."

Removal of Bitcoin Apps

On February 5th, 2014, Apple removed the Blockchain Bitcoin app from the iOS app store without explanation. Blockchain responded by claiming Apple had removed the app as an aggressive move against future competition:

"These actions by Apple once again demonstrate the anti-competitive and capricious nature of the App Store policies that are clearly focused on preserving Apple's monopoly on payments rather than based on any consideration of the needs and desires of their users."[88]

On February 6th, Bloomberg[91] reported that while applications monitoring Bitcoin prices remained in the store, but the Bitcoin transaction apps Coinbase and Gliph had been removed.

Reception

As of March 2013, Bitcoin users and miners congregate on Reddit[14] and the Bitcoin Talk Forums[15], among numerous other smaller groups. There is also a Wiki[21] and the online publication Bitcoin Magazine[18] that gathers information about the currency and keeps track of its exchange rates. Since 2011, Bitcoin conferences have been held annually[16] throughout Europe, with the first US conference scheduled for May 2013.[18]

Crash in April 2013

During the first few days of April, more than 75,000 new accounts were created on the Bitcoin exchange site Mt. Gox, or 125% more than the total number of signups in the previous month. On April 10th, 2013, Mt.Gox saw triple the average amount of daily trades, which their servers could not handle. The same day, Bitcoin prices dropped from $265 to $156 over the course of six hours, hitting a low of $105 at one point.[61] In early speculation, Ars Technica[58] noted that the price drop came several hours after Redditor bitcoinbillionaire[59] gave away nearly $12,000 USD to 13 seemingly random Redditors in a thread titled “I wish for the price to crash.”[60] on the Bitcoin subreddit. The Verge[61] reported that the crash was likely caused by DDoS attacks targeting Mt. Gox and other Bitcoin exchange sites earlier in the day, prompting investors to sell off their Bitcoins. During the time of the price drop, people were reporting a trade lag of 73 minutes on Mt. Gox.[66]

In the early morning of April 11th, Mt. Gox’s Twitter account confirmed[62] that the site was still under a DDoS attack and issued a press release[63] stating that the recent massive interest in Bitcoin trade had caused the site to lag. In response to the attacks and the server issues, they also announced that that they were going to shut down trading completely for 24 hours to let the market “cool down.” Within three hours, news of Mt. Gox’s temporary shutdown resulted in nearly 400 comments on a Reddit thread[64] and launched another discussion[65] on whether or not Mt. Gox should be phased out as the default Bitcoin exchange.

Crash in February 2014

On February 7th, 2014, the Bitcoin exchange Mt. Gox[88] announced they would be temporarily pausing all Bitcoin withdrawals to work on a transaction bug. The same day, the announcement was posted to the /r/bitcoin[92] subreddit, where commenters discussed the role programmer Mark Karpeles played in the transaction problems. On February 10th, Mt. Gox[90] posted a follow-up announcement claiming that a bug in the bitcoin software allowed users to duplicate transactions. On the same day, programmer Andreas Antonopoulos tweeted that the bugs were not unanticipated and added "Gox is full of shit."

Unanticipated bugs don’t come with year-old wiki pages fully documenting them. Gox is full of shit:

https://t.co/9htPeb6ytM

— AndreasMAntonopoulos (@aantonop) February 10, 2014

Also on February 10th, the Bitcoin Price Index CoinDesk removed Mt. Gox for failing to freezing Bitcoin withdrawals. Meanwhile, OptionsHawk Research founder Joe Kunkle tweeted a graph showing the price of Bitcoin rapidly falling. After remaining around $900 to $1000 for much of 2014, the price plunged to $535 before recovering to $636.

If BitCoin were a stock you would be running for the hills pic.twitter.com/qbiSTF8TWE

— Joe Kunkle (@OptionsHawk) February 10, 2014

In 2017, Splinter News[101][102] published a series of articles about Bitcoin: "All This Bitcoin Stuff Is Fake" and "Hey Idiots--You're Gonna Lose All Your Money on Bitcoin, Idiots." In the latter, writer Hamilton Nolan wrote, "Bitcoin is a fake and made-up scam. Can you articulate what it is? “Bullshit jargon that means nothing”-you. Hell no. All we can say for sure about this imaginary “coin” is that it is going to cost you a bundle (sucker)."

Controversies

Thefts

Since Bitcoin transactions cannot be reversed, if Bitcoins are stolen from a user’s digital wallet, they cannot be replaced. One of the earliest Bitcoin robberies occurred in June 2011, when a user known as Allinvain reported[30]25,000 Bitcoins (approximately $467,000 at the time) stolen from his account. It was later believed to have been caused by a Trojan virus[31] that would hack into unencrypted wallets and forcefully carry out the transfers. between 2012[32] and 2013,[33] there have been several reports of large sums of Bitcoins stolen from exchange sites, leading some enthusiasts to suggest offline storage of Bitcoin codes, either on encrypted hard drives that are not connected to the Internet or by physically writing them down. Bitcoin owner Charlie Shrem[41] has a ring with an engraving of his codes (shown below, left) to protect his investment and entreprenuer Mike Caldwell[35] has minted more than $2.5 billion in physical Bitcoins (shown below, right).

Trojan Virus

On April 4th, 2013, Dmitry Bestuzhev from computer security company Kaspersy Lab identified a virus[45] spreading through Skype which turned an infected computer into a Bitcoin miner. Bestuzhev pointed out that when the infiltration is repeated over time, the malware would be able to harness the power of thousands of computers to unlock Bitcoins at a rapid rate. The offending link was receiving an average of 2,000 clicks per hour at the height of its spread, with victims targeted in at least seven countries. At the time Bestuzhev’s article was published, the link had been clicked more than 11,000 times. The story was shared on Wired[46] the following day, with additional coverage from Slashgear[47], BBC[48] and Net Security[49] that week.

Ponzi Schemes

On July 23rd, 2013, the U.S. Securities and Exchange Commission (SEC) charged Texas resident Trendon T. Shavers[76] with operating a Ponzi scheme to raise at least 700,000 Bitcoins, or equivalent to $4.5 million at the time, from investor and misappropriating nearly 150,000 BTC for his personal use. According to the SEC, Shavers (a.k.a pirateat40) launched the First Pirate Savings & Trust (later renamed the Bitcoin Savings & Trust) through the Bitcoin Talk forums[70] in November 2011, enticing potential investors with up to a 7% interest rate on deposits of 2000 BTC or more.

On August 18th, 2012, Shavers closed down the service[71] after a handful of Bitcoin Talk users suspected it of being a fraudulent scheme.[72] When the closure was announced, Bitcoin prices dropped from $15 each to $10 (shown above). At the time of the closure, Shavers claimed to have 500,000 BTC, worth more than $5.6 million at the time.[73] He initially promised to refund everyone’s deposits plus interest, leading Bitcoin Forum users to create a thread[74] to monitor the progress of repayments. In the following weeks, after only one investor confirmed receiving any payment, members of Bitcoin Talk proceeded to dox Shavers[75] and track his location to Texas.

As the case is one of the first criminal prosecutions relating to Bitcoin, news of the charges appeared on a number of news and tech blogs as well as finance sites including The Daily Dot[77], Wired[78], Tech Dirt[79], The New York Times Deal Book[80] and CNN Money.[81]

Money Laundering

On January 27th, 2014, the U.S. federal authorities arrested Charlie Shrem (shown below), the CEO of Bitcoin exchange website BitInstant, at the JFK International Airport on charges of laundering more than $1 million worth of bitcoins for Silk Road customers and operating an unlicensed money-transmitting business. On the following day, the FBI arrested one of Shrem’s suspect partners Robert Faiella on the same charges. According to the criminal complaint and an investigation by the Internal Revenue Service, Shrem and Faiella exchanged $1.05 million in bitcoins over a 10-month period, during which they stayed in touch via e-mail correspondences to ensure that their transactions remain undetected from cash-processing companies.

On February 6th, the Miami Beach Police Department, in conjunction with the state attorney's office and the U.S. Secret Service, arrested two men for allegedly running an illegal business that involves trading large volumes of currency for Bitcoin. According to the court documents and cybersecurity news blog Krebs On Security,[89] Florida residents Michell Espinoza and Pascal Reid were arrested on two counts of money laundering and one count of engaging in an unlicensed money servicing business after they showed up at a meeting which had been arranged via Bitcoin exchange site LocalBitcoins[93] by undercover state and federal agents under the pretext of discussing the use of Bitcoin to purchase stolen credit card numbers.

Mt. Gox Shutdown

On February 23rd, 2014, CEO Mark Karpeles of the bitcoin exchange Mt. Gox resigned from the board of the Bitcoin Foundation. The same day, the @MtGox Twitter feed deleted its entire tweet history. On February 24th, Mt. Gox suspended all trading. On the following day, Forbes[94] published an article reporting the the company's shutdown was rumored to involve the theft of 744,000 bitcoins, which was valued to over $409 million at the time.

Usage

As of March 2013, a number of online businesses and non-profit organizations[43] accept Bitcoins, most notably 4chan,[44] Wikileaks,[38] Reddit[39] and OkCupid.[40] Additionally, the Internet Archive has offered their employees an option to receive a portion of their paychecks in Bitcoins.[41] There are also a handful of Bitcoin casinos[42] where players will bet anywhere from ฿66,000 to ฿1,787,470 per year, depending on the site.

In December 2014, Microsoft also started accepting Bitcoins for digital goods,[97] a move which came after their February update to Bing that allowed bitcoin price conversions through the search engine.

Silk Road

Bitcoins are the only currency accepted on Silk Road, an online black market that can only be accessed via The Onion Router (TOR). Though the site launched in February 2011, the site did not receive mainstream attention until Gawker[37] published an expose on it in June of that year. Silk Road allows people to buy a number of items including drugs, apparel, books, digital goods, drug paraphernalia, erotica and forgeries. In July 2012, it was estimated[36] that more than 1.2 million dollars US in sales were being generated monthly by the site.

Alternative Cryptocurrencies

Coinye

Coinye is an alternative cryptocurrency featuring the face of the American celebrity rapper Kanye West and launched by an anonymous group which aims to simplify the mining process through a front-end platform called "CoinyeMiner" and thus bring cryptocurrency to the masses. Coinye was scheduled to be released for public use on January 11th, 2014, however, the co-founders were forced to abandon the project during the days leading up to the launch, soon after receiving a cease-and-desist letter, followed by the subsequent filing of a trademark infringement suit.

Dogecoin

Dogecoin is an alternative cryptocurrency based on the popular Shiba Inu meme Doge and launched as a satire of the Bitcoin boom in late December 2013. Similar to Bitcoin and its derivatives, Dogecoin can be mined and exchanged for goods and services among the participants, though it is programmed to level out at a higher threshold of up to 100 billion coins and prevent any use of special bitcoin-mining equipment like ASICs.

RonPaulCoin

RonPaulCoin is an alternative cryptocurrency featuring the face of the retired libertarian congressman Ron Paul and based on Litecoin’s SCRYPT-based protocol. In comparison to other leading alternative cryptocurrencies, RonPaulCoin is decisively limited in its scope and circulation volume with a market threshold of up to 2.1 million coins, about one tenth of Bitcoin's 21 million cap.

NyanCoin

NyanCoin is an alternative crypto currency which uses the cartoon Internet meme Nyan Cat as its mascot. On January 2nd, 2014, two different cryptocurrencies named "NyanCoin" were launched on the same day, though one of them quickly fell out of favor after it was accused of having been pre-mined, or the often-deceptive practice of allocating a certain portion of the currency's total volume to the founders or early adopters prior to its public release. By January 6th, Nyan Cat creator Chris Torres had officially endorsed the non-premined version and the founders of the currency announced their partnership with Torres for the first “officially licensed cryptocurrency" in the BitCoin Talk Forums.[83] Powered by the Scrypt algorithm, the official licensed NyanCoin has a total of 337,000,000 coins with 337 coins per block and a difficulty retarget time of three hours.

On January 13th, the /r/NyanCoin[84] subreddit was launched for discussions regarding the altcoin. On January 23rd, The Register [85] published an article about the new cryptocurrency. On January 27th, The Daily Dot[86] published an article outlining the history of NyanCoin, which included statements from Torres and the NyanCoin creators.

Related Memes

Please Can I Borrow Some Bitcoin?

Around December 10th, 2017 a scam began spreading through Tumblr in which accounts would be hacked then send direct messages to other users requesting Bitcoin. This led users to post warnings about the scam. For example, user iron-thorn[104] posted a lengthy post explaining the scam that gained over 104,000 notes. This led to memes about the scam spreading through Tumblr. For example, Tumblr user woodmeat[105] uploaded a I Don't Understand This Meme edit that gained over 27,000 notes (shown below, left). User avenging-at-beach-city[106] uploaded an I Will Survive edit joking about bitcoin that gained over 650 notes (shown below, right). Meme Documentation[107] covered the spread of the jokes on December 11th.

Search Interest

External References

[2] Wikipedia – Cryptography

[3] Wikipedia – Cypherpunk

[4] Cypherspace – Cypherpunks Mailing List

[6] Carnegie Mellon – Cryptography: It’s Not Just For Electronic Mail Anymore

[7] The University of Southern California – Electronic Currency for the Internet

[8] Bitcoin Wiki – Satoshi Nakamoto

[9] Bitcoin.org – Bitcoin: A Peer-to-Peer Electronic Cash System

[10] The Mail Archive – cryptography: Bitcoin P2P e-cash paper

[11] Bitcoin Wiki – Genesis Block

[12] The Times – Chancellor Alistair Darling on brink of second bailout for banks

[13] The Mail Archive – cryptography: Bitcoin v0.1 released

[14] Reddit – /r/Bitcoin

[16] 2011 Bitcoin & Future Technology European Conference – Home

[17] Bitcoin Magazine – The Two Bitcoin Conferences of 2013

[20] Business Insider – ANALYST: Bitcoin Took A Key Step Towards Going Mainstream, And That's Why It's Been Going Crazy The Last Two Days

[23] Bitcoin Wiki – Block Chain

[24] Bitcoin Wiki – Proof of Work

[24] BlockExplorer – Probability

[26] Coding In My Sleep – Bitcoin Mining in Plain English

[28] FinCEN – Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies\

[29] Ars Technica – US regulator: Bitcoin exchanges must comply with money-laundering laws

[30] Bitcoin Forum – I just got hacked – any help is welcome! (25,000 BTC stolen)

[31] Symantec – All your Bitcoins are ours…

[32] Ars Technica –

Hacker steals $250k in Bitcoins from online exchange Bitfloor

[33] The Verge – Hackers steal over $12,000 of Bitcoins from transaction broker Bitinstant

[34] Wired – Ring of Bitcoins: Why Your Digital Wallet Belongs On Your Finger

[35] Casascius – Physical Bitcoins

[36] Cornell University Library – Traveling the Silk Road: A measurement analysis of a large anonymous online marketplace

[37] Gawker – The Underground Website Where You Can Buy Any Drug Imaginable

[38] Wikileaks – WikiLeaks Bypasses Financial Blockade With Bitcoin

[39] TechCrunch – Reddit Starts Accepting Bitcoin for Reddit Gold Purchases Thanks To Partnership With Coinbase

[40] Reddit – /r/Bitcoin: OkCupid, one of the biggest dating sites just (manually) accepted Bitcoin!

[41] Internet Archive Blog – Employees to be Paid in Bitcoin: Please Donate

[42] Forbes – Bitcoin Casinos Release 2012 Earnings

[43] SpendBitcoin – Places that Accept Bitcoins Directly

[45] Securelist – Skypemageddon by bitcoining

[46] Wired – Trojan Turns Your PC Into Bitcoin Mining Slave

[47] Slashgear – Skype trojan turns your computer into a Bitcoin miner

[48] BBC News – Skype trojan forces Bitcoin mining, security firm warns

[49] Net Security – Bitcoin-mining Trojan lurking on Skype

[50] Forbes – Why I'm Not Ready To Sell My Bitcoins

[51] Business Insider – A Flash Crash In The Bitcoin Market This Week Revealed The Currency's Biggest Problem

[52] Yahoo! Finance – Bitcoin Prices Blast Through $100, Driving Speculators Wild

[53] Business Insider – ANALYST: All Of My Clients Think There's A Bitcoin Bubble, But A 'Perfect Storm' Is Causing Prices To Surge

[54] The Guardian – Bitcoin currency value reaches record high of $147 before plunging down

[55] NewStatesman – Bitcoin is in hyperdeflation

[56] VentureBeat – Bitcoin wallet service Instawallet hacked, shuts down ‘indefinitely’

[57] CNN – Major Bitcoin exchanges hit with cyberattacks

[58] Ars Technica – Bitcoin crashes, losing nearly half of its value in six hours

[59] Reddit – Overview for bitcoinbillionaire

[60] Reddit – /r/Bitcoin: I wish for the price to crash

[61] The Verge – Bitcoin price fluctuates wildly after massive run-up, DDoS attacks reportedly to blame (update)

[62] Twitter – @MtGox: Maintenance Over however we are now under a DDoS attack.

[63] Mt.Gox – Hi everyone, just a quick update on the situation and what happened last night.

[64] Reddit – /r/Bitcoin: Order Placing Suspended on MT.Gox

[65] Reddit –

[66] The Daily Dot – Bitcoin just took a major nosedive--but why?

[67] Reddit – I think this subreddit should seriously consider having suicide hotline info posted.

[68] Bitcointalk – People are going to die (rant)

[69] Bitcoin Talk – Summary – pirateat40

[70] Bitcoin Talk – First Pirate Savings and Trust

[71] Bitcoin Magazine – Bitcoin Savings & Trust – Genuine or Joke?

[72] Bitcoin Talk – Classic ponzi, with a classic ponzi closing statement.

[73] The Verge – Suspected multi-million dollar Bitcoin pyramid scheme shuts down, investors revolt

[74] Bitcoin Forum – Bitcoin Savings & Trust – Money Returned List (One reported – CLOSED).

[75] Bitcoin Talk – Re: centralized post of pirate payouts or other related news to the closing.

[76] SEC – Securities and Exchange Commission against Trendon T. Shavers and Bitcoin Savings and Trust

[77] The Daily Dot – "Bernie Madoff of Bitcoin" charged in $4.5M Ponzi scheme

[78] Wired – SEC Says Man Fittingly Named ‘The Pirate’ Ran Bitcoin Ponzi Scheme

[79] Techdirt – SEC Confirms That Bitcoin Savings & Trust Was A Ponzi Scheme; Files Lawsuit

[80] NY Times Deal Book – S.E.C. Says Texas Man Operated Bitcoin Ponzi Scheme

[81] CNN Money – Bitconned: SEC busts alleged Bitcoin Ponzi scheme

[82] Cryptocoin Talk – Nyan Coin

[83] Bitcoin Talk – The first officially licensed cryptocurency

[84] Reddit – /r/nyancoins

[85] The Register – Cryptocurrencies now being pooped out by cartoon cat

[87] Mt Gox – Statement Regarding BTC Withdrawal Delays

[88] CNN – Apple removes blockchain

[89] KrebsonSecurity – Florida Targets High-Dollar Bitcoin Exchangers

[90] Mt Gox – Dear mtgox customers

[91] Bloomberg – Apple Removes Blockchain

[92] Reddit – MtGox announcement

[93] LocalBitcoins – Buy and sell bitcoins

[94] Forbes – Bitcoins Mt Gox Goes Offline

[95] Newsweek – The Face Behind Bitcoin

[96] Twitter – @GavinAndresen's Tweet

[97] Engadget – Microsoft Now Takes Bitcoins

[98] Quartz – Bitcoin just hit $10,000 for the first time

[99] Quartz – Nasdaq joins the Wall Street gold rush to offer bitcoin futures

[100] BBC – Bitcoin: What's behind the gold rush?

[101] Splinter News – All This Bitcoin Stuff Is Fake

[102] Splinter News – Hey Idiots--You're Gonna Lose All Your Money on Bitcoin, Idiots

[103] Select All – No Stopping? After New High, Bitcoin Price Eyes $20k

[104] Tumblr – iron-thorn

[106] Tumblr – avenging-at-beach-city

[107] Meme Documentation – Explained Requesting Bitcoin